Leverage is a powerful tool in trading that allows traders to control larger positions with a smaller initial investment. While leverage can amplify profits, it also increases the potential for losses, making it crucial for traders to use it wisely. In this article, we will explore what leverage is, how it works in trading, and how you can use it safely on the GMGN platform.

1. Understanding Leverage in Trading

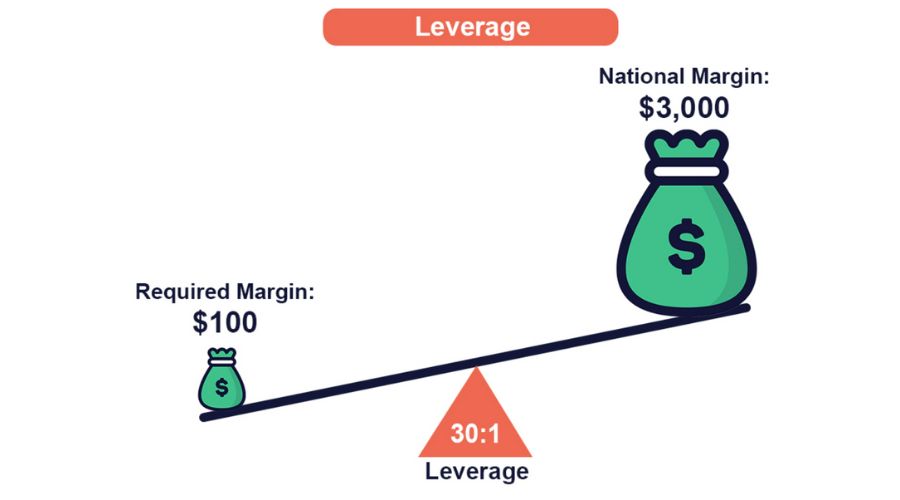

Leverage in trading refers to the ability to control a larger position in the market with a smaller amount of capital. It is expressed as a ratio, such as 1:10, 1:50, or 1:100, where the first number represents the trader’s own capital and the second number represents the total position size they can control. For example, with 1:50 leverage, a trader can control $50,000 worth of assets with just $1,000 of their own funds.

While leverage can increase potential profits, it also increases risk. If the market moves against your position, losses are magnified, making it essential to use leverage with caution.

For more details on how GMGN handles leverage, visit their broker page: https://stakingy.com/brokers/gmgn

2. How Leverage Works on GMGN

On GMGN, traders can access leverage to trade various financial instruments, including Forex, cryptocurrencies, and commodities. The platform offers competitive leverage options, allowing you to increase your market exposure without needing a significant upfront investment.

GMGN’s leverage options vary depending on the asset you’re trading. It’s important to carefully select the appropriate leverage based on your risk tolerance and trading strategy.

3. Benefits of Using Leverage

- Increased Profit Potential: Leverage allows traders to make larger profits from smaller price movements in the market.

- Access to Larger Markets: With leverage, traders can access markets that may otherwise be out of their reach with limited capital.

- Efficient Capital Use: Leverage allows traders to maintain a diversified portfolio without tying up large amounts of capital.

4. Risks of Leverage

While leverage can increase profits, it also amplifies losses. A small market movement in the wrong direction can result in significant losses, even exceeding your initial investment. Therefore, it’s crucial to use leverage responsibly and ensure you are prepared for potential risks.

5. How to Use Leverage Safely on GMGN

Using leverage safely is all about managing your risk. Here are some key tips for using leverage on GMGN:

- Start Small: If you’re new to leverage, it’s advisable to start with smaller leverage ratios and gradually increase as you gain experience.

- Use Stop-Loss Orders: Implementing stop-loss orders can help limit your losses if the market moves against you.

- Monitor Your Positions: Always keep a close eye on your trades when using leverage to avoid unexpected losses.

- Understand Your Risk: Never trade with more leverage than you’re willing to lose. Be sure to assess your risk tolerance before entering a trade.

For more information on leverage options available on GMGN, check out this link: https://gmgn.ai/?ref=FKNvP6Qi&chain=sol

Leverage can be a valuable tool in trading, allowing traders to increase their potential profits. However, it is essential to understand how leverage works and to use it responsibly. By starting small, using stop-loss orders, and monitoring your trades, you can take advantage of leverage on GMGN without exposing yourself to unnecessary risk. With proper risk management, leverage can enhance your trading strategy and help you navigate the markets more effectively.